FLAGSHIP REPORT

Electrolyser Leaderboard and Manufacturing Insights Q1 2025

The looming consolidation in landscape, cancellations/ shut-down of factories and emergence of few dominant players

USD $ 3,990

This report provides critical insights into the fast-changing landscape of Electrolyser OEMs (ELY) and how it is expected to evolve towards 2030 in terms of technology, geography, business model, concentration, etc. Further, the report investigates the manufacturing capacity & utilization trends of OEMs and provides commentary on potential demand-supply scenarios incl. whether there is really an oversupply problem.

Key Takeaways

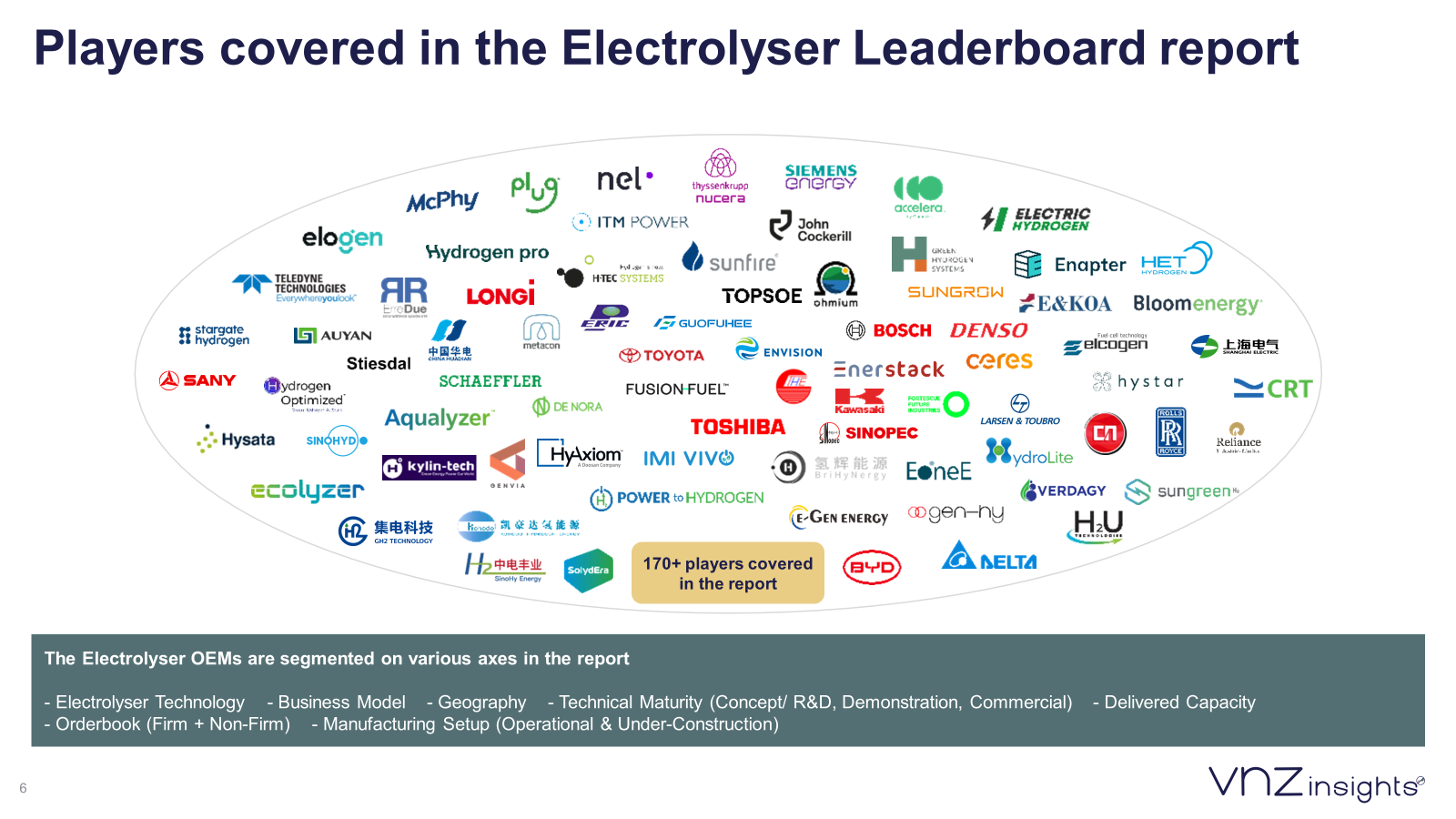

- There are 300+ players currently active in Electrolyser landscape with 382 positions spread across different ELY technologies. Highest concentration is in Europe and China.

- Contrary to the popular belief, our findings suggest Chinese players working actively on PEM, SOEC and AEM technologies to challenge Western dominance.

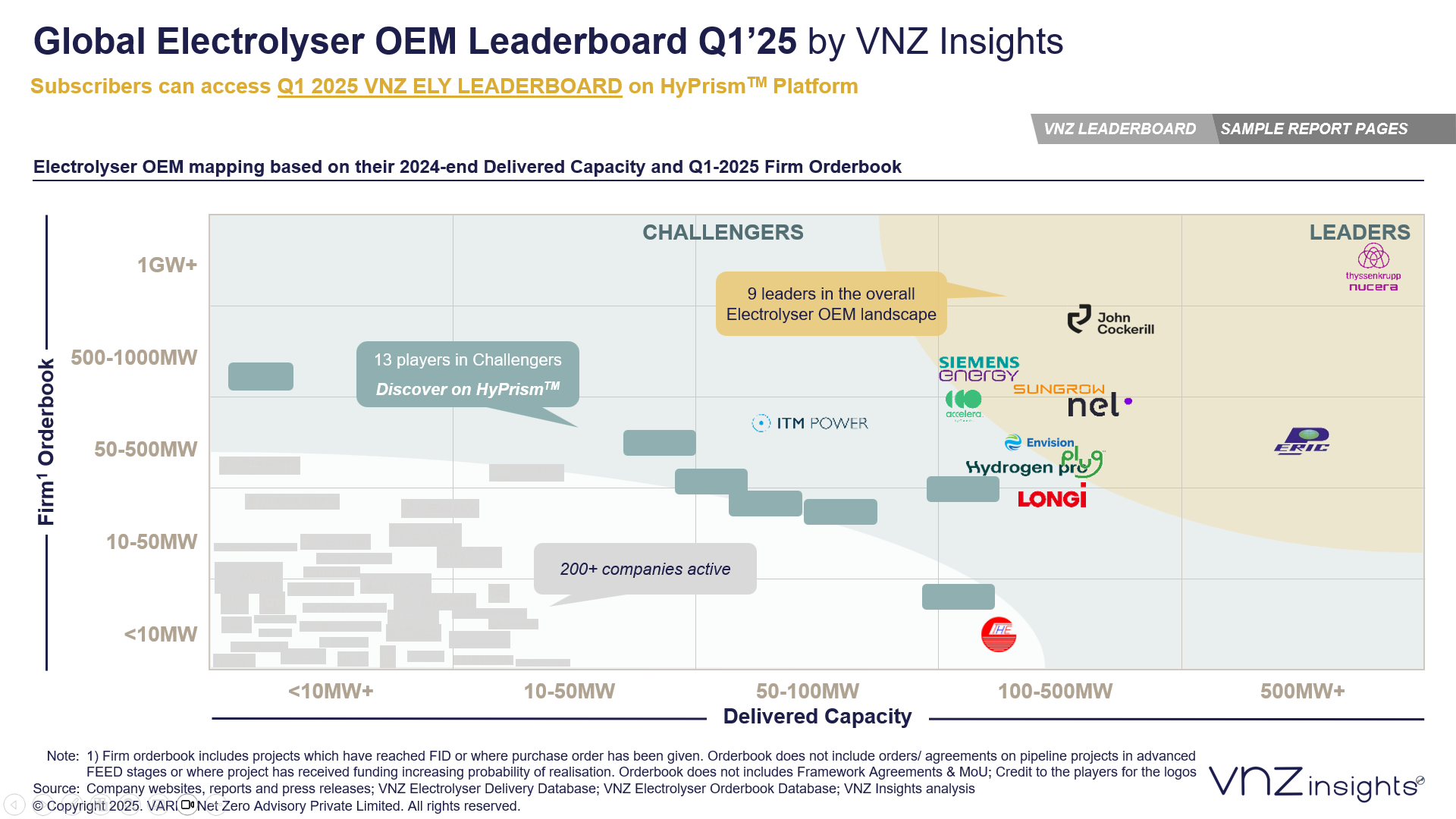

- Global current electrolyser delivered and orderbook capacity is highly concentrated among top 22 players which we have classified as market Leaders and Challengers.

- There are four major trends on technology and geographical footprint of OEMs that will significantly impact the landscape towards 2030

- The operational and under-construction capacity for Electrolyser stacks currently stands at ~79 GW out of which ~38 GW is with Leaders and Challengers. China accounts for ~63% of the capacity followed by Europe.

- Beyond the 79 GW, the electrolyser OEMs have announced ~75 GW capacity towards 2030.

- Cumulative electrolyser installations expected to reach 50-60GW towards 2030 to cater to increasing green hydrogen demand globally driven by the large-scale projects of 200MW+ capacity with off-take application in ammonia, methanol, and steel.

Key Questions Addressed

Who are the Leaders, Challengers, Emerging Challengers and Innovators in Electrolyser OEM landscape?

- How is the landscape of 300+ companies segmented by electrolyser technology, technical maturity, geography, and business model?

- Who are the Leaders and Challengers in market based on delivered capacity and orderbook globally and in China?

- What are the major trends within the Electrolyser OEM landscape by concentration, geography, business model, etc.?

- How is the landscape expected to evolve towards 2030 based on the major trends?

- What is the electrolyser supply capacity today based on operational and under-construction capacity and how is it segmented by

- ELY OEMs: Leaders, Challengers, Emerging Challengers and Innovators

- By Electrolyser Technology

- By Geography

- How does the supply scenario change if we include announced capacities of OEMs by 2030?

- What is the global demand for electrolyser towards 2030 in different scenarios? How is the demand segmented by geography and by electrolyser technology, by project size and player type?

- What are the demand-supply dynamics by electrolyser technology and geography towards 2030?

Who needs this report?

- Electrolyser OEMs: Sales battlecards, Footprint/capacity planning, Competitive intelligence on ELY technology and geography, M&A planning.

- Asset developers and EPCs: Electrolyser Category Intelligence for Sourcing Planning, Strategy and M&A Planning.

- Supply Chain Players: Big-small among Electrolyser OEMs and which ones are critical to bet on towards 2030.

- Investors: Market Intelligence for target screening and due diligence on Electrolyser OEMs.

- Policy Makers & Think-tanks: Intelligence to design effective subsidy and incentive structure.

OTHER REPORTS YOU MAY BE INTERESTED IN

REPORT

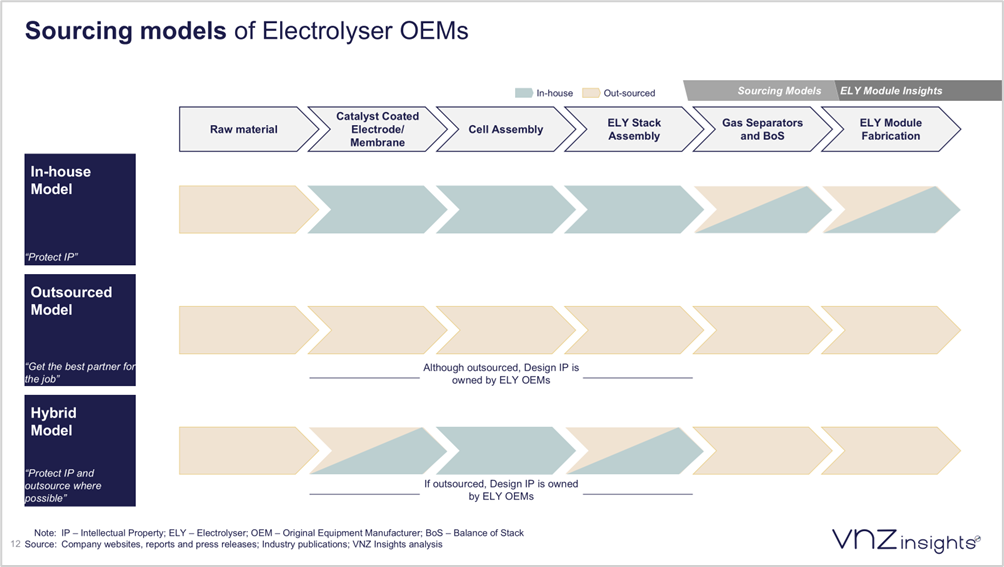

How electrolyser OEMs and suppliers are restructuring sourcing, manufacturing, and delivery for 50 MW+ hydrogen projects

REPORT

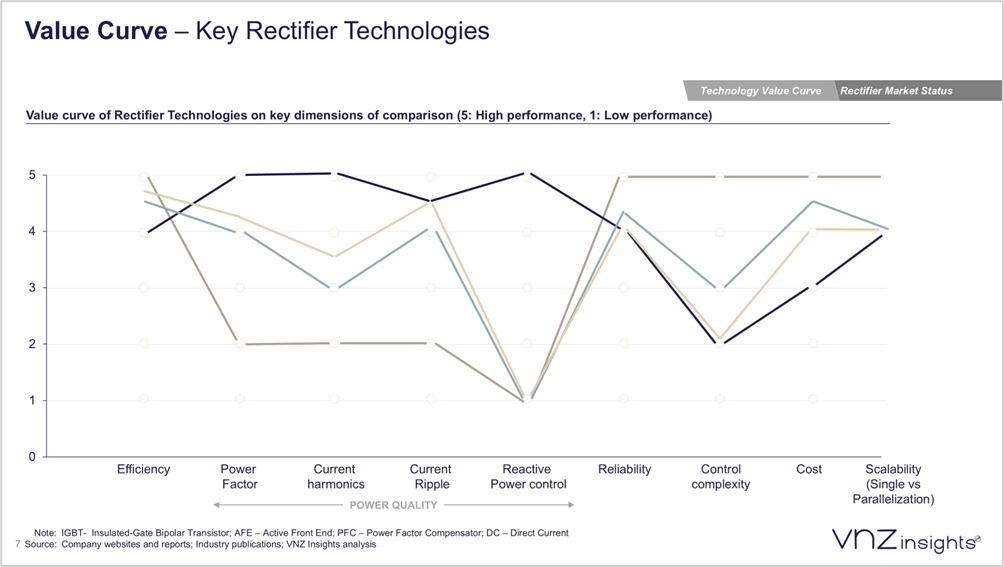

Rectifier and power supply unit technologies, market dynamics, and supplier positioning across global electrolyser projects

REPORT

Strategic Shifts, Technology Differentiation, and the Global Expansion of Chinese Electrolyser OEMs