FLAGSHIP REPORT

Electrolyser Module Supply Chain Trends Report

How electrolyser OEMs and suppliers are restructuring sourcing, manufacturing, and delivery for 50 MW+ hydrogen projects

Price USD 4,990

Electrolyser Module Supply Chain Trends Report

Electrolyser OEMs and component suppliers driving strategic shifts in sourcing models, manufacturing partnerships, R&D initiatives and capacity expansion to enable large-scale green hydrogen projects and accelerate global deployment. This report provides critical insights into how electrolyser OEMs and their supply chain partners are reconfiguring scope of delivery, sourcing models, and manufacturing strategies as the market transitions to large-scale projects (50 MW+). It analyzes technology choices (Alkaline vs. PEM), component-level dependencies, evolving EPC roles, and localization dynamics with a practical lens on what gets delivered by whom, at what scale and how partnerships are shifting across the value chain.Key Takeaways

- <50 MW projects increasingly served via full-scope plug‑n‑play systems; ≥50 MW projects use ELY modules which can be pre‑fabricated for PEM and assembled on-site for Alkaline.

- EPCs expected to lead multi-package sourcing for large-scale projects with OEMs narrowing scope to Stack + Stack BoP

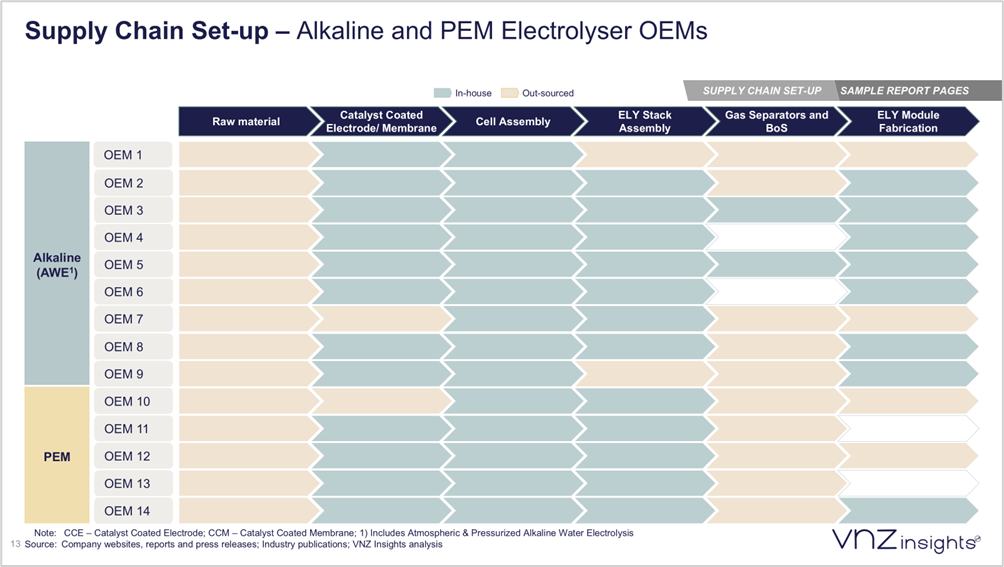

- Alkaline systems rely on third-party raw material sourcing with high dependency on diaphragms and catalysts from specialized suppliers.

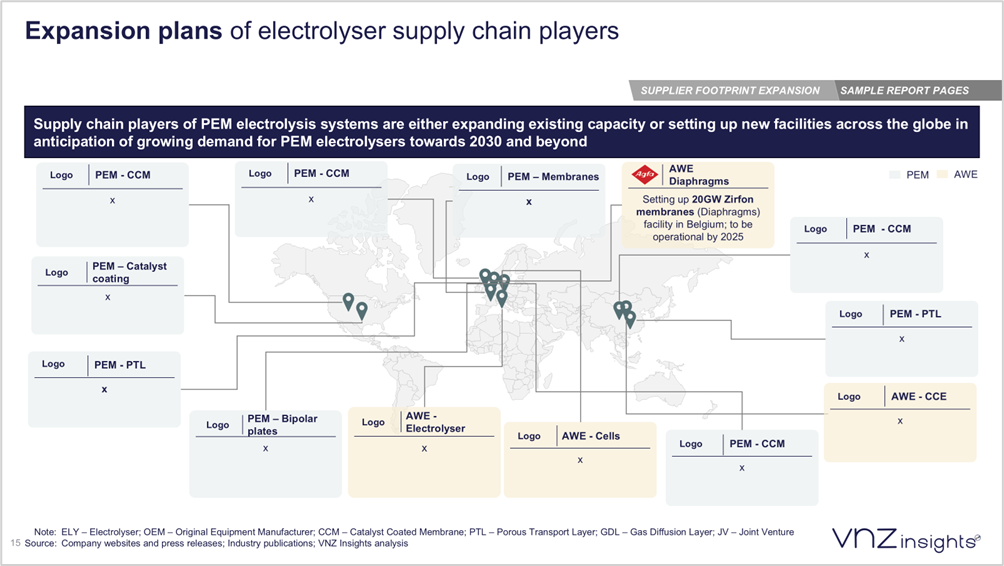

- PEM systems show high concentration of suppliers for membranes, catalysts, PTL, and bipolar plates; CCMs typically developed in-house by leading OEMs.

- R&D partnerships focus on cost and efficiency - Alkaline targets non-PGM catalysts and diaphragm thickness reduction; PEM targets membrane optimization, PFSA substitutes, PGM reduction, and PTL resistance reduction.

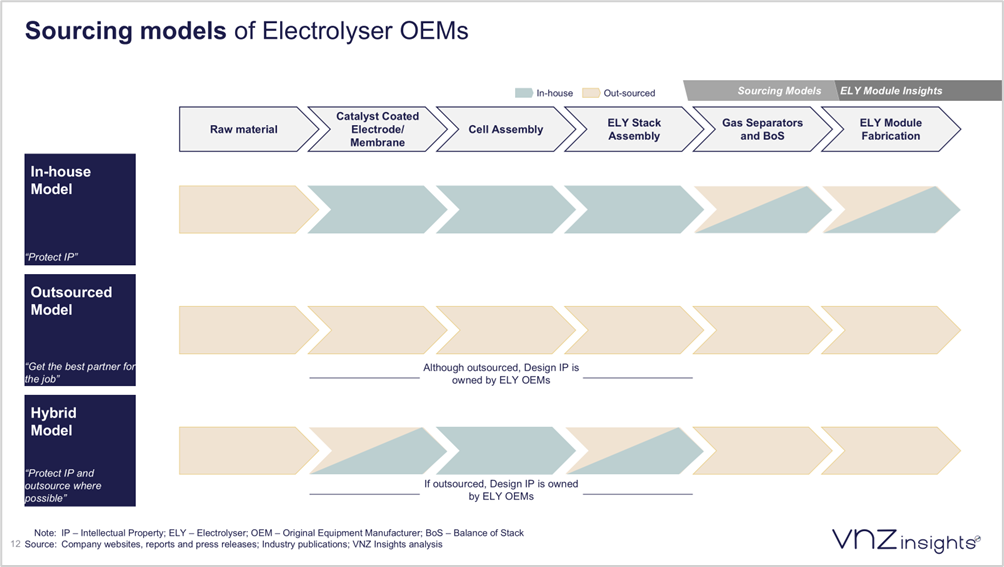

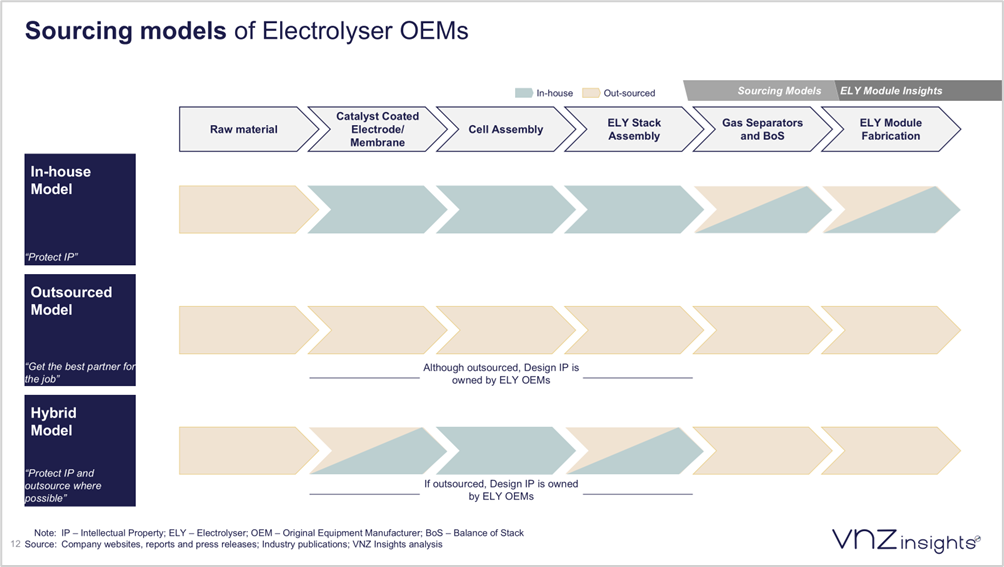

- Most OEMs prefer in-house cell & stack assembly with a few OEMs have outsource set-up. The focus is on scaling from MW to GW through automation, supported by recent public funding.

Key Questions Addressed

What exactly is in scope and how is it changing?

- How do scope of delivery and sourcing models differ between <50 MW plug n play and ≥50 MW module-based projects?

- What scope EPCs deliver, and how are OEMs refocusing on Stack + Stack BoP?

- Which components (e.g., diaphragms, membranes, PTL, catalysts) are most constrained, and how are OEMs mitigating risk?

- How are R&D partnerships (materials, coatings, PFSA substitutes, PGM reduction) changing performance and cost curves?

- Who keeps electrode coating, CCM/MEA, stack assembly in-house—and who partners or outsources?

- How are automation investments accelerating the leap to GW-scale manufacturing?

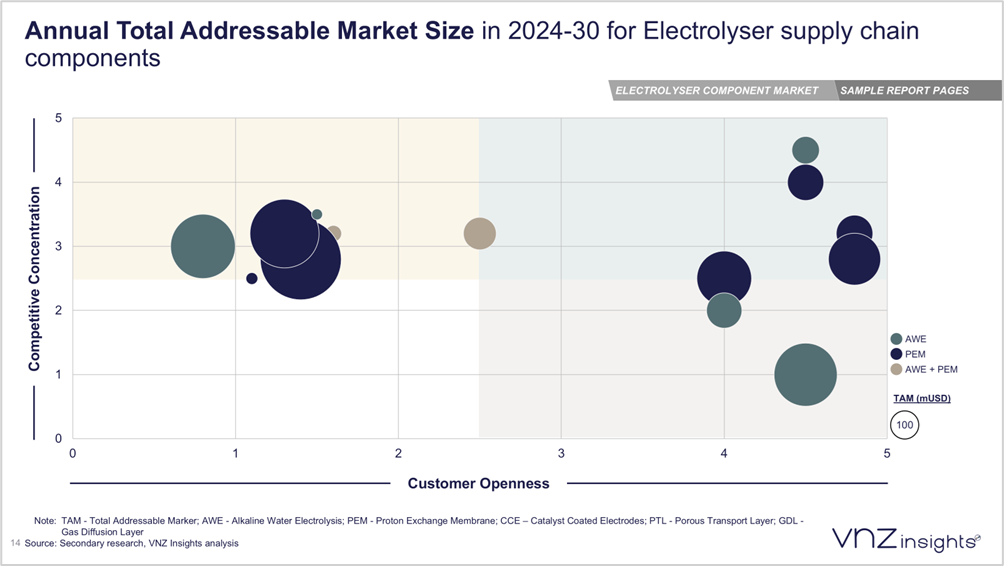

- Which components show the highest TAM and competitive intensity, and how does this influence OEM sourcing decisions?

- How do cost, localization, and supplier diversification impact route-to-market for critical components like membranes, catalysts, and MEA?

Who needs this report?

This report is relevant for stakeholders active across the Green Hydrogen ecosystem.

OTHER REPORTS YOU MAY BE INTERESTED IN

REPORT

How electrolyser OEMs and suppliers are restructuring sourcing, manufacturing, and delivery for 50 MW+ hydrogen projects

REPORT

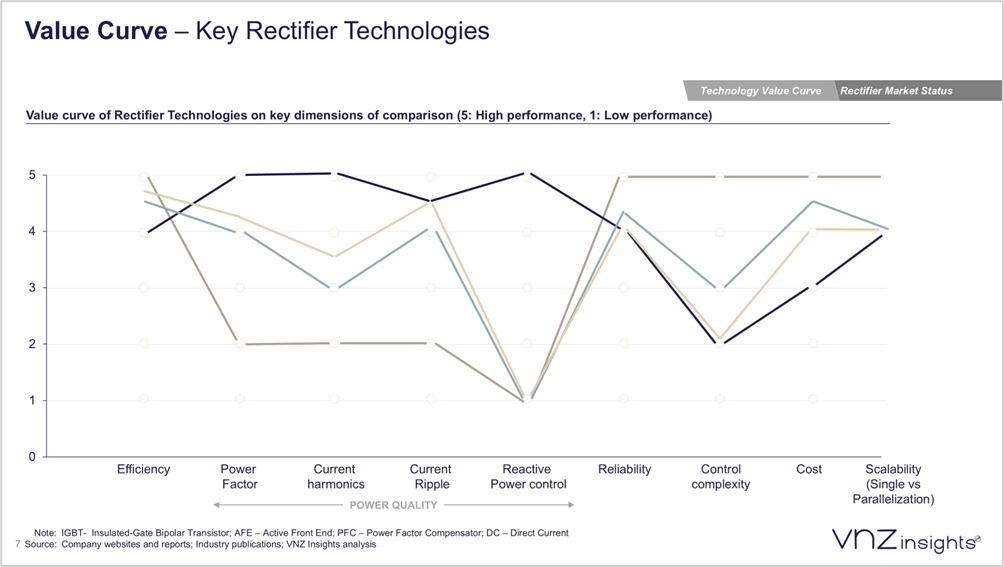

Rectifier and power supply unit technologies, market dynamics, and supplier positioning across global electrolyser projects

REPORT

Strategic Shifts, Technology Differentiation, and the Global Expansion of Chinese Electrolyser OEMs