FLAGSHIP REPORT

Electrolyser OEM Business Model Trends Report 2025

Strategic Shifts, Technology Differentiation, and the Global Expansion of Chinese Electrolyser OEMs

Price USD 4,990

Electrolyser OEM Business Model Trends Report 2025

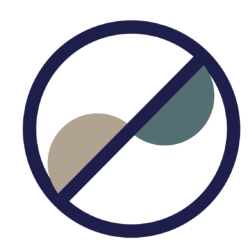

Strategic Shifts by Electrolyser OEMs amid market headwinds, expansion of Chinese OEMs technologically and geographically. This Report provides critical insights into the emerging electrolyser OEM business model trends with shifts in strategy across technology, new revenue streams, cost-cutting initiatives, target customer segments incl. geography, project-size, application end-use, partnerships across the value-chain, and footprint & channels with key focus on expansion initiatives of Chinese ELY OEMs across the globe.Summary: What This Report Covers

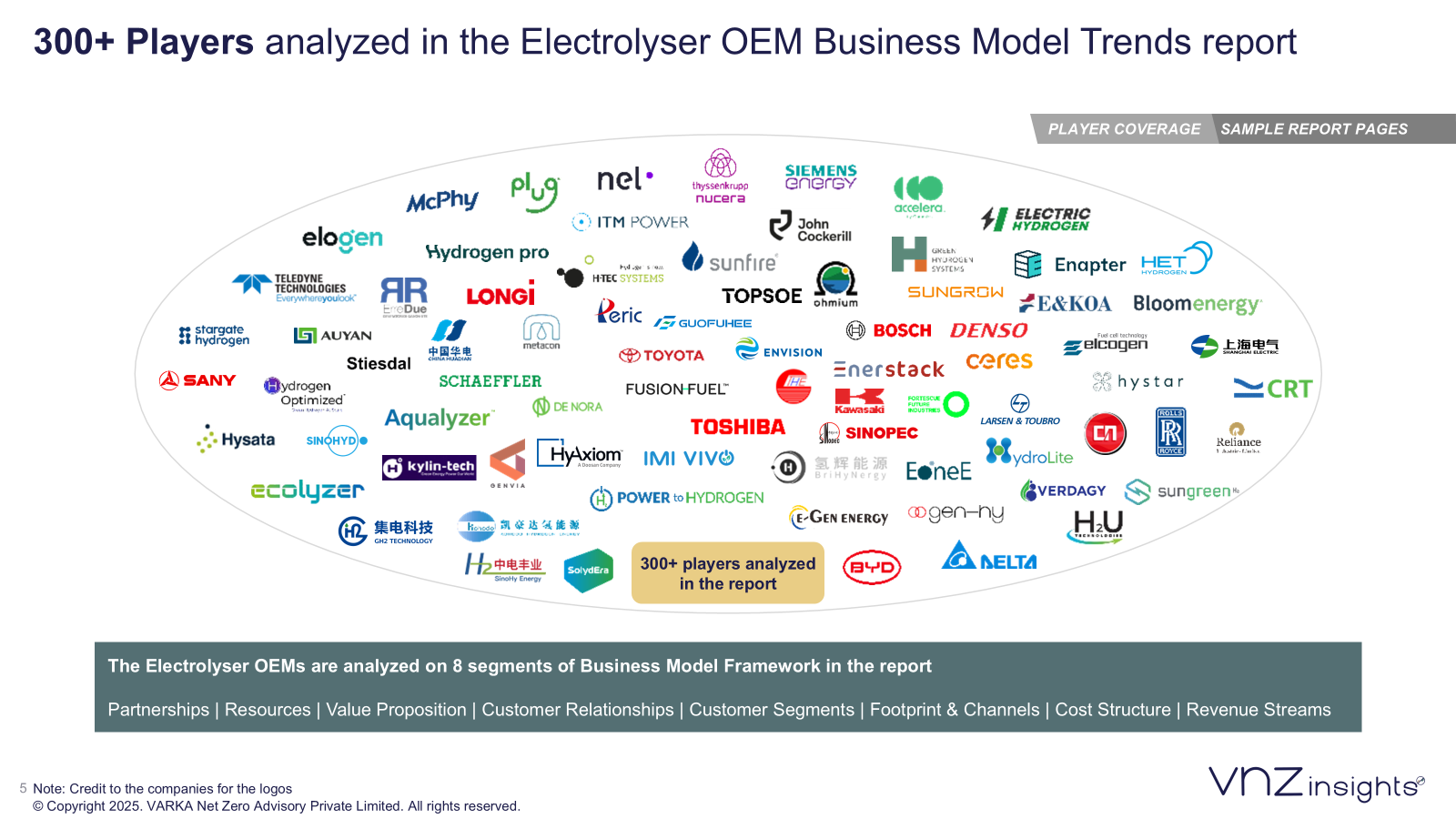

- Technology and product strategy evolution across global OEMs

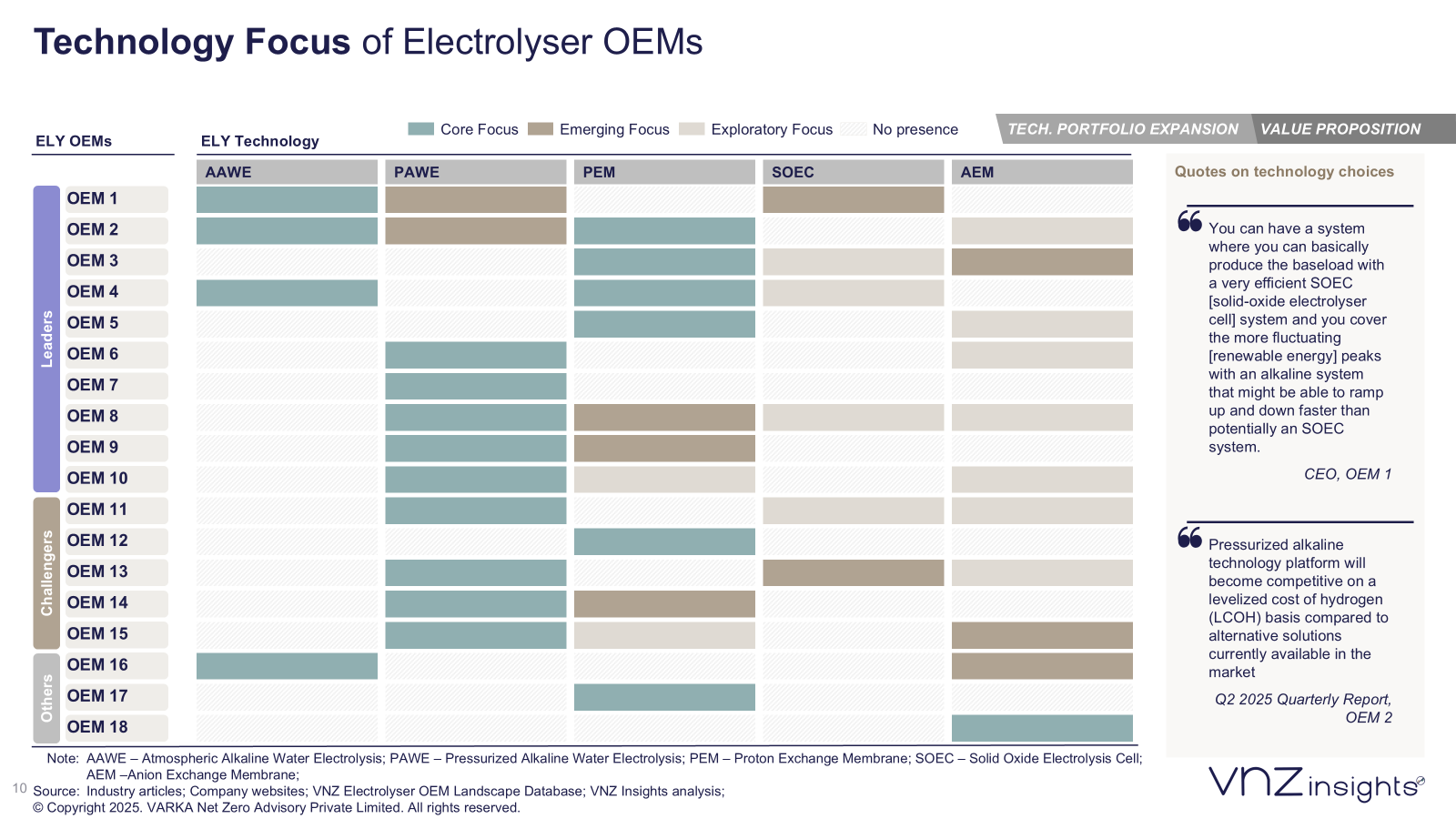

- Revenue diversification, O&M models, licensing and service offerings

- Cost-reduction strategies and competitive levers across OEM types

- Customer segmentation by project size, sector, and geography

- Partnership structures with EPCs, gas companies, developers, SI partners

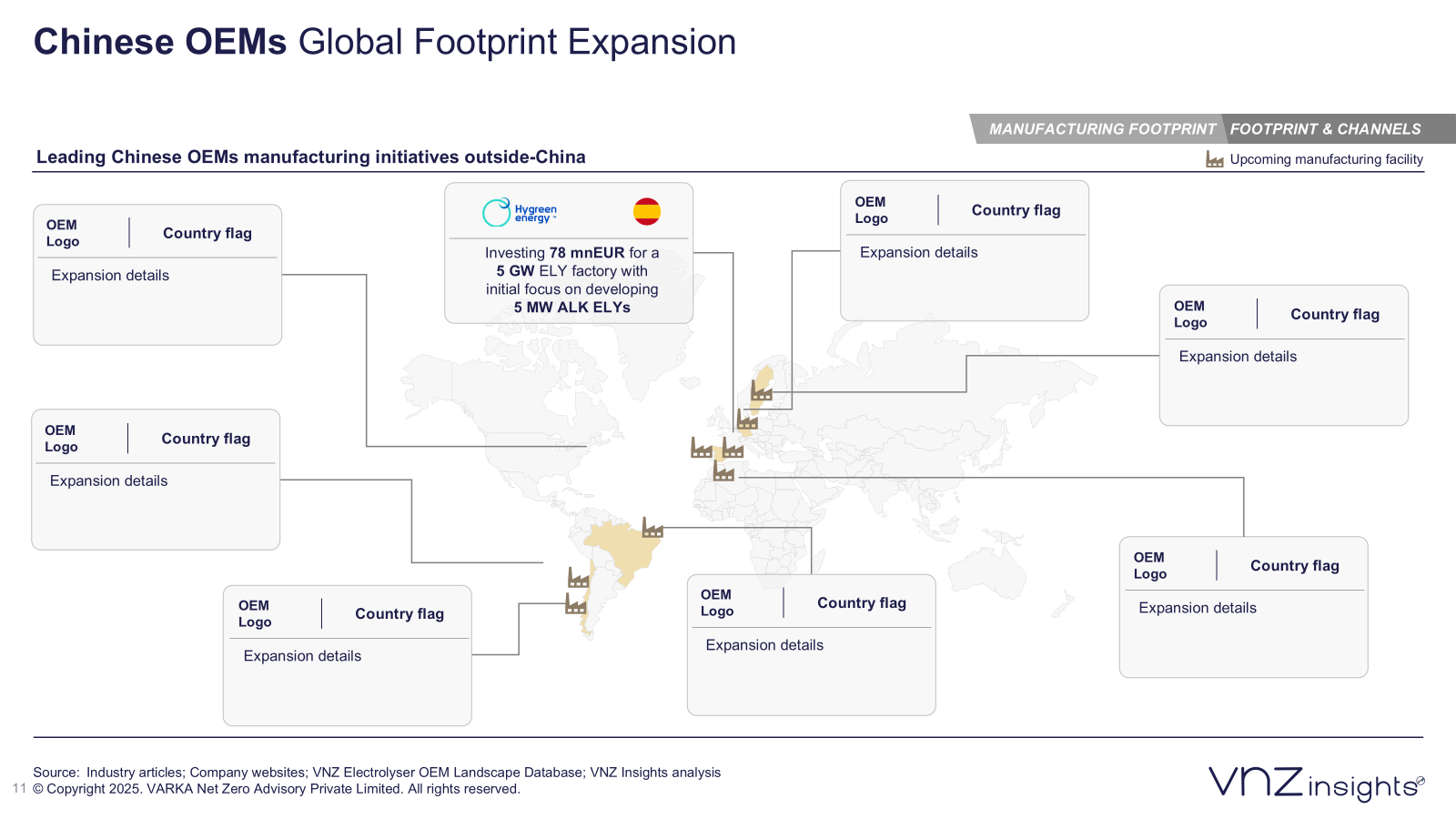

- Global expansion playbooks of Chinese OEMs

- IP acquisition, consolidation trends, and emerging M&A patterns

- OEM footprint evolution, supply chain dependencies, and channels

Key Takeaways

- Electrolyser OEMs have taken positions by project size - major OEMs targeting >50MW, few niche OEMs focused on <50 MW and some OEMs focused across project sizes.

- In terms of H2 end-use majority OEMs remain agnostic to hydrogen end-use; few OEMs are aligning with specific sectors such as Fuels & Chemicals, and Mobility

- Three geographic strategy archetypes emerging - Global focused OEMs including Chinese OEMs, Europe focused OEMs and Chinese OEMs focused on serving local demand

- Electrolyser OEMs are differentiating through 100 MW standard plants, O&M services, design packages, tech licensing, and Hydrogen-as-a-Service model.

- Chinese OEMs are expanding globally via localization, sales and technology licensing partnerships and technology certifications.

- Intellectual Property (IP) acquisition opportunities emerging with ongoing consolidation wave with multiple companies already acquired IPs, facilities and other resources

- Additionally, electrolyser OEMs are focusing on relationships with customers including gas companies to gain electrolyser OEMs going forward.

- Many more trends by player type, technology, geography, revenue streams, cost-cutting, footprint and channels can be found in the report.

Key Questions Addressed

Who Are Electrolyser OEMs Targeting as Customers?

- How are OEMs segmenting their offerings by project size (e.g., <50 MW vs. >100 MW)?

- Which geographies are OEMs prioritizing, and how do Western vs. Chinese OEMs differ?

- Are OEMs aligning their strategies with specific hydrogen end-use sectors like ammonia or mobility?

- What standardized electrolyser solutions (e.g., 100 MW plants) are OEMs launching?

- How are OEMs expanding their technology portfolios to be ready for next battlefront?

- What role does Hydrogen-as-a-Service play in OEMs’ business models?

How Are OEMs Generating Revenue and Reducing Costs?

- How are OEMs monetizing aftermarket services and what is the projected O&M market size?

- How are OEMs using licensing and stack integration partnerships to diversify revenue?

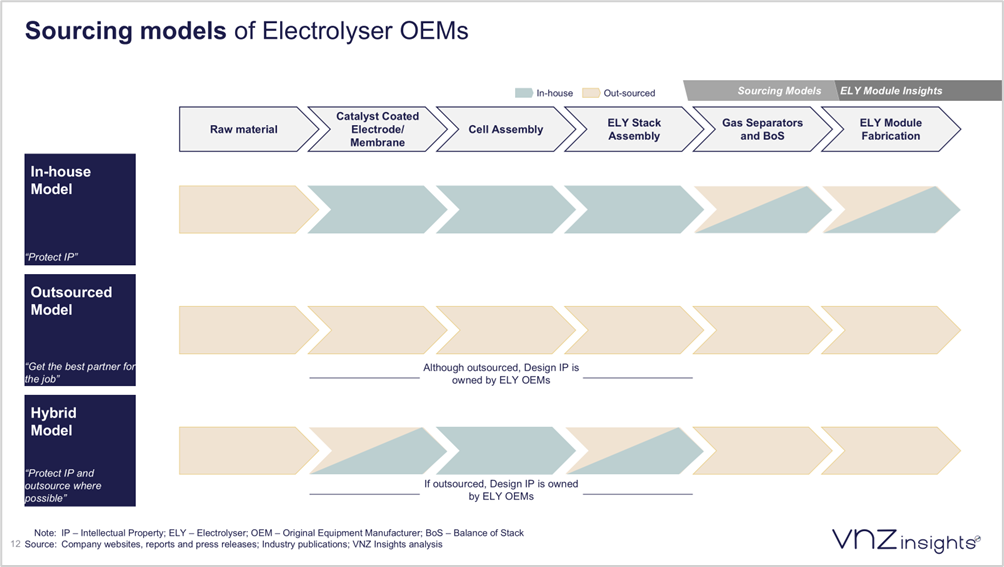

- What cost-reduction strategies are OEMs implementing—automation, stack scaling, outsourcing?

- How are Chinese OEMs expanding globally through JVs, equity investments, manufacturing and partnerships?

- What strategic partnerships are OEMs forming with EPCs, gas companies, and developers to secure future electrolyser contracts?

Who needs this report?

This report is relevant for stakeholders active across the Green Hydrogen ecosystem.

OTHER REPORTS YOU MAY BE INTERESTED IN

REPORT

How electrolyser OEMs and suppliers are restructuring sourcing, manufacturing, and delivery for 50 MW+ hydrogen projects

REPORT

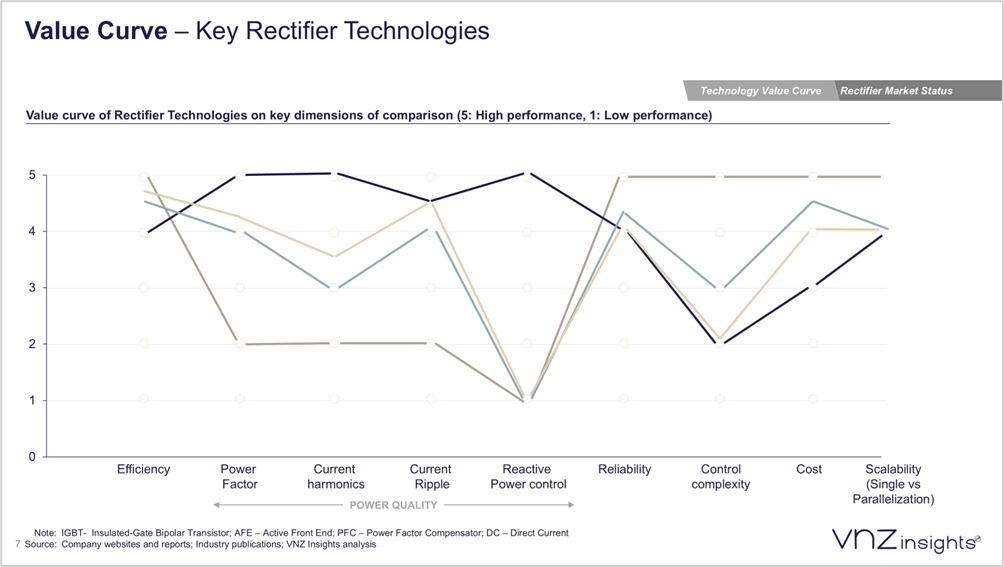

Rectifier and power supply unit technologies, market dynamics, and supplier positioning across global electrolyser projects

REPORT

Strategic Shifts, Technology Differentiation, and the Global Expansion of Chinese Electrolyser OEMs