FLAGSHIP REPORT

Rectifier and Power Supply Unit for H2 Electrolyser Insights Report

Rectifier and power supply unit technologies, market dynamics, and supplier positioning across global electrolyser projects

Price USD 4,990

Rectifier and Power Supply Unit for H2 Electrolyser Insights Report

Strategic insights on rectifier technologies, market dynamics, and supplier landscape amid growing green hydrogen demand. This report provides critical insights into the evolving role of rectifiers/power supply units in green hydrogen projects, analysing technology trends, market sizing, supplier strategies, and sourcing dynamics. It covers technology preferences by electrolyser type, project size, and geography, along with competitive positioning of global players and innovation pathways toward 2030.Key Takeaways

- With increasing green hydrogen demand towards 2030, ~2 bn USD market will open for Power Supply Units deployment.

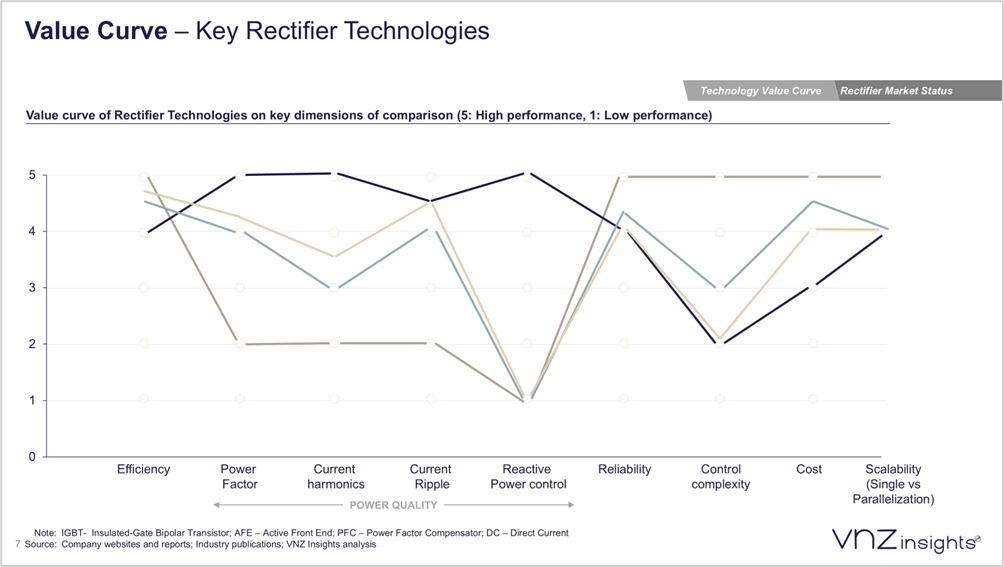

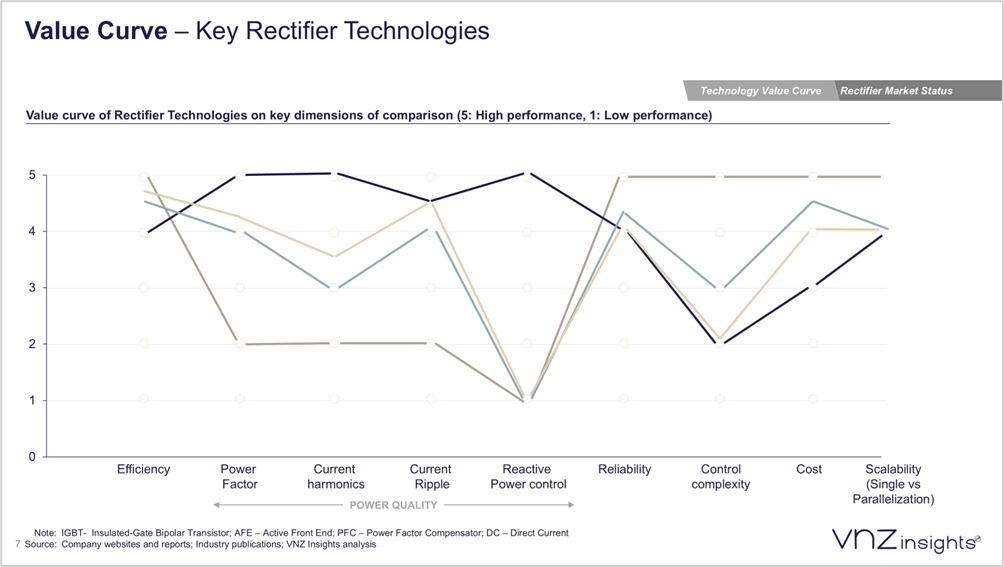

- Four rectifier technologies dominate the market - Thyristor, IGBT AFE, Diode + IGBT Chopper, and Thyristor + IGBT Chopper, each offering unique trade-offs in cost and power quality.

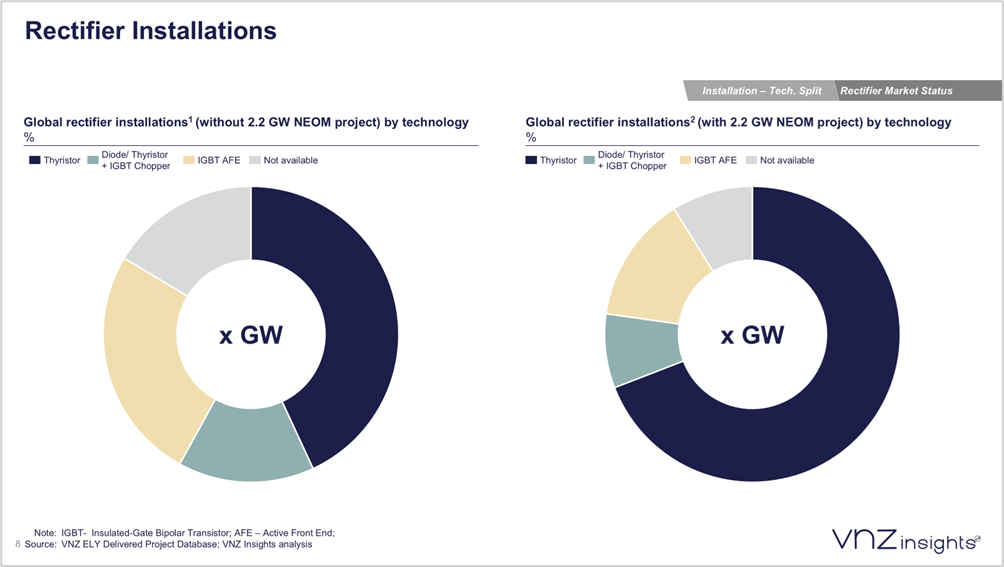

- Current installed and under-construction capacity of 2.6 GW shows Thyristor is the most preferred technology including deployment on NEOM project, followed by IGBT AFE and Diode/Thyristor + IGBT Chopper

- Technology preference varies by electrolyser type - Alkaline systems majority use Thyristor, PEM systems lean towards IGBT and PAWE systems favor Diode/Thyristor + IGBT Chopper.

- Large-scale modules of 20 MW+ typically use Thyristor, while IGBT adoption is rising in stacks of 10 MW+.

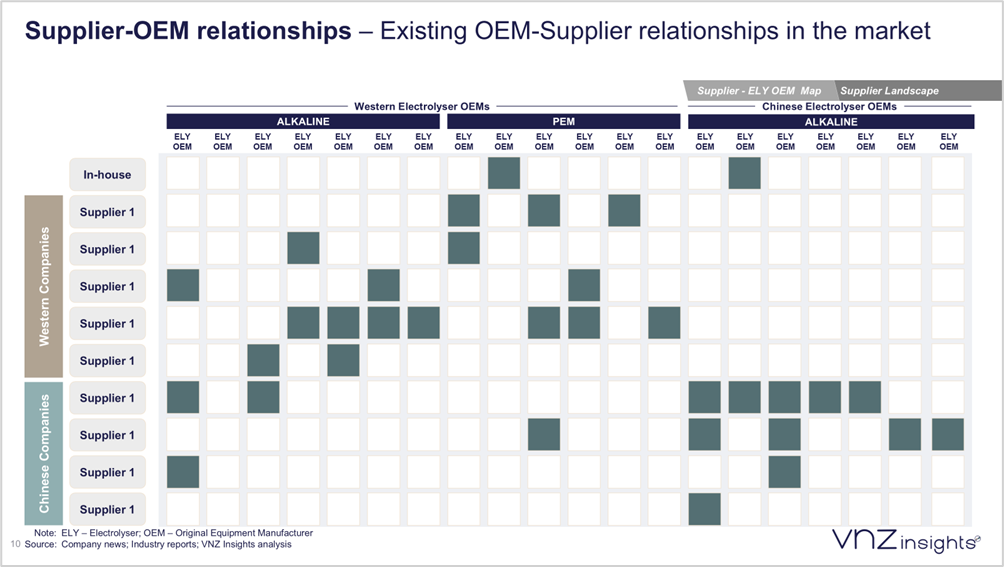

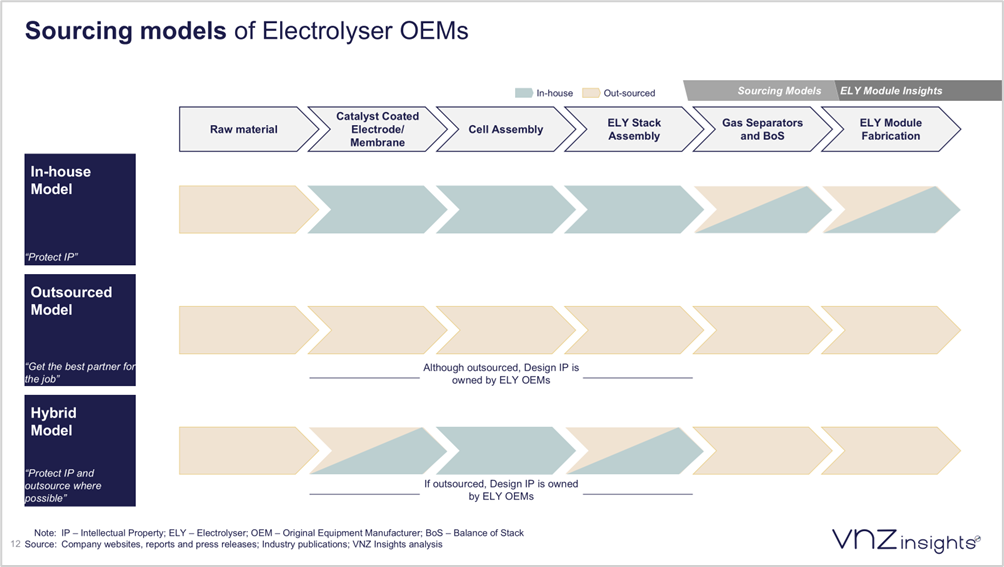

- Sourcing dynamics are shifting, with OEMs leading in small to mid-scale projects and EPCs increasingly taking control of large-scale procurement as project sizes exceed 400MW+.

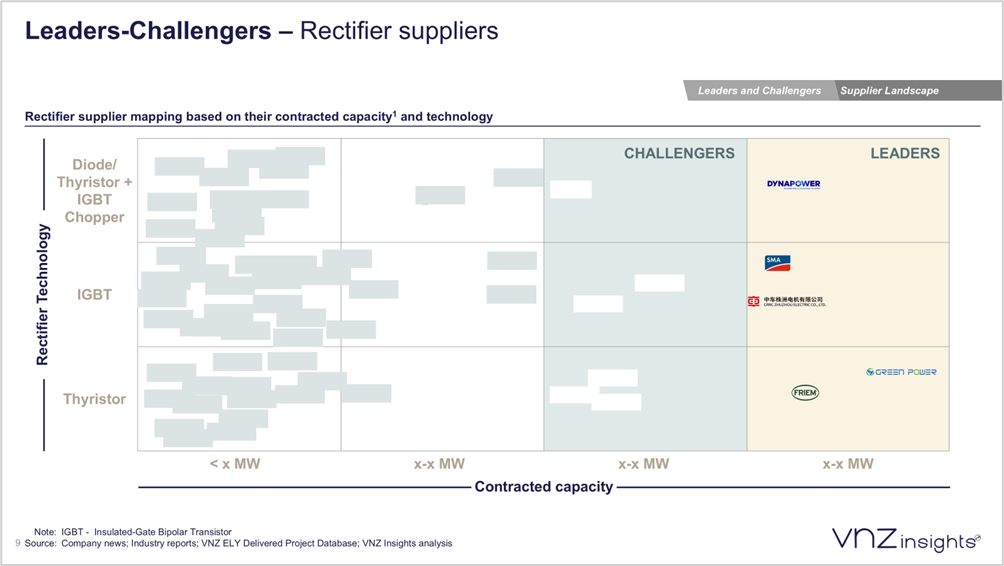

- 40+ global players are active, concentrated in Europe and China, with top 10 classified as Leaders and Challengers, driving innovation toward larger stacks and higher current density by 2030.

Key Questions Addressed

What Drives Rectifier Technology Choices in Green Hydrogen Projects?

- How do Thyristor, IGBT AFE, and hybrid chopper technologies compare along the value-curve including cost, efficiency and power quality?

- Which electrolyser technologies (Alkaline vs. PEM) align with specific rectifier types?

- What are the implications of increasing stack sizes of alkaline and PEM technology on rectifier capacity and configuration?

- How does the requirement for current and voltage impact rectifier design compared to similar systems like wind turbine converters?

- Which companies lead in Thyristor, IGBT, and hybrid chopper technologies?

- How are suppliers expanding capabilities – manufacturing expansion, FEED service support, containerized solutions development?

- What impact will larger alkaline stacks (up to 40 MW) and PEM stacks (up to 12 MW) have on rectifier design and specifications?

- How will economies of scale in IGBT converters influence cost competitiveness, and what risks arise from Chinese players entering this space?

Who needs this report?

This report is relevant for stakeholders across the Green Hydrogen ecosystem, including:

- Rectifier and power electronics manufacturers

- Electrolyser OEMs

- EPCs and project developers

- Asset owners and investors

OTHER REPORTS YOU MAY BE INTERESTED IN

REPORT

How electrolyser OEMs and suppliers are restructuring sourcing, manufacturing, and delivery for 50 MW+ hydrogen projects

REPORT

Rectifier and power supply unit technologies, market dynamics, and supplier positioning across global electrolyser projects

REPORT

Strategic Shifts, Technology Differentiation, and the Global Expansion of Chinese Electrolyser OEMs