FLAGSHIP REPORT

2024 Electrolyser Market Report Card by VNZ Insights

60+ pager report providing an in-depth status check on electrolyser market- by players, technology, geography, project size, and offtake and the expectations for 2024-25

US $ 3,990

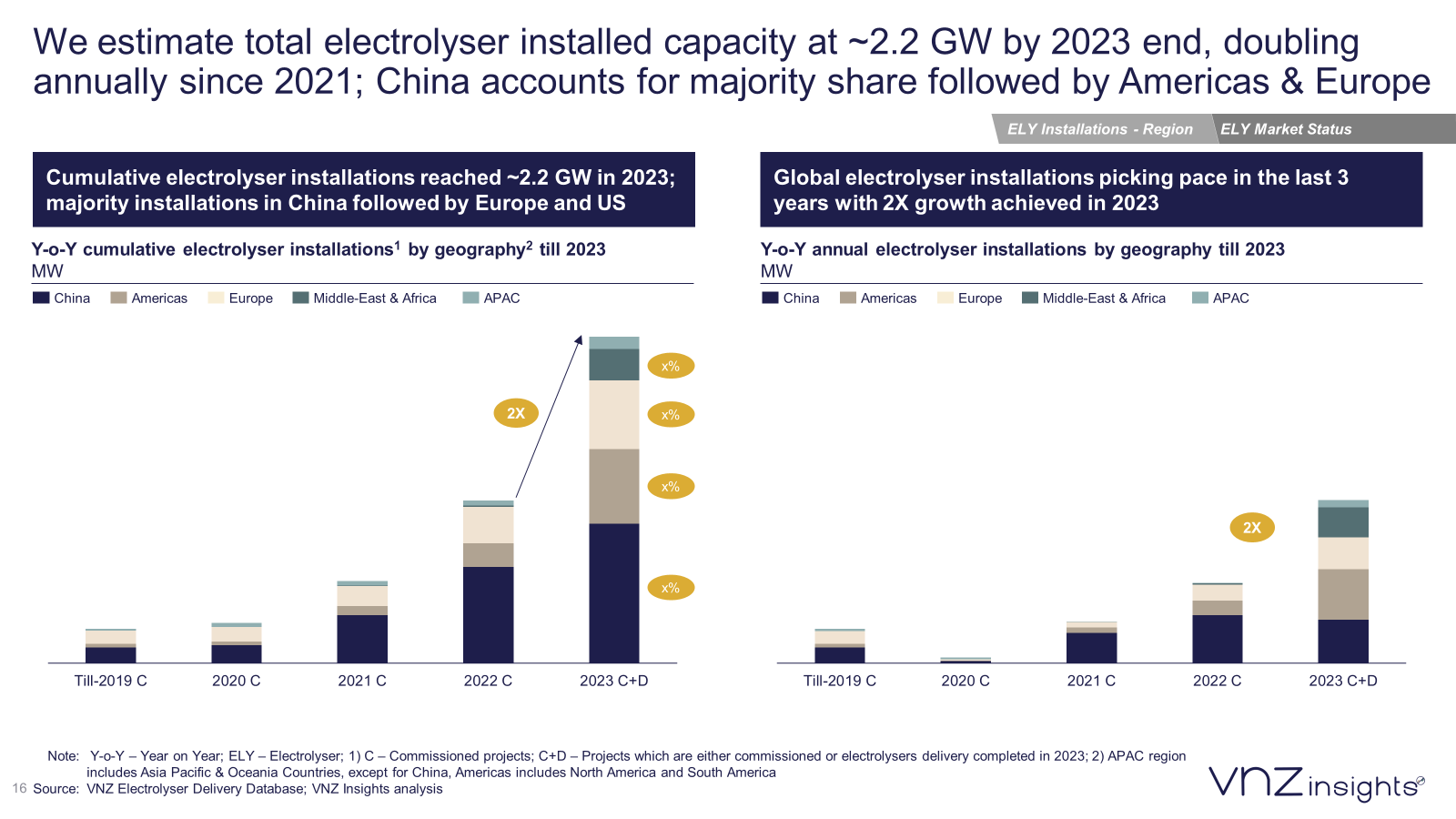

VNZ Report card on Electrolyser market provides an in-depth overview of electrolyser delivered capacity by 2024 and expectations for 2025-26:

- Global & Regional Electrolyser installation trends

- By cumulative/annual capacity

- By electrolyser technology: ALK, PEM, SOEC, AEM, Others

- By Electrolyser OEMs

- By Asset Owners

- By Region

- By Project size: 200MW+, 50-200MW, 5-50MW, 1-5MW, sub-MW

- By Electrolyser stack size: 20MW+, 10-20MW, 5-10MW, 1-5MW, Sub-MW

- Global & Regional Electrolyser orderbook trends

- By contract type: firm orderbook, non-firm orderbook, non-firm pipeline

- By Electrolyser OEMs

- By Asset Owner and plants

- By ELY technology: ALK, PEM, SOEC, AEM, Others

- By Region

- By Project size

- By Electrolyser Stack size

- Deep dive market summaries for

- China

- Germany

- USA

- India

- Denmark

- Kingdom of Saudi Arabia

Key Takeaways

- Market Growth: Global electrolyser deliveries exceeded 6 GW by the end of 2024, with ~3.2 GW delivered in 2024 alone

- China's Dominance: China continues to drive the electrolyser market with nearly half of the global electrolyser delivered in China at end of 2024

- Order Surge: 2024 saw 3.2 GW in firm orders, bringing the total orderbook at the end of Q1 2025 to 8.9 GW

- Market Leaders: thyssenkrupp nucera completed ~1 GW electrolyser deliveries (partial) in 2024 while John Cockerill led the firm order award with ~0.6 GW order.

Key Questions Addressed

- Global & Regional Electrolyser installation trends

- By cumulative/annual capacity

- By electrolyser technology: ALK, PEM, SOEC, AEM, Others

- By Electrolyser OEMs

- By Asset Owners

- By Region

- By Project size: 200MW+, 50-200MW, 5-50MW, 1-5MW, sub-MW

- By Electrolyser stack size: 20MW+, 10-20MW, 5-10MW, 1-5MW, Sub-MW

- Global & Regional Electrolyser orderbook trends

- By contract type: firm orderbook, non-firm orderbook, non-firm pipeline

- By Electrolyser OEMs

- By Asset Owner and plants

- By ELY technology: ALK, PEM, SOEC, AEM, Others

- By Region

- By Project size

- By Electrolyser Stack size

- Deep dive market summaries for

- China

- Germany

- USA

- India

- Denmark

- Kingdom of Saudi Arabia

Who needs this report?

This report is relevant for everyone involved in the Green Hydrogen ecosystem.

OTHER REPORTS YOU MAY BE INTERESTED IN

REPORT

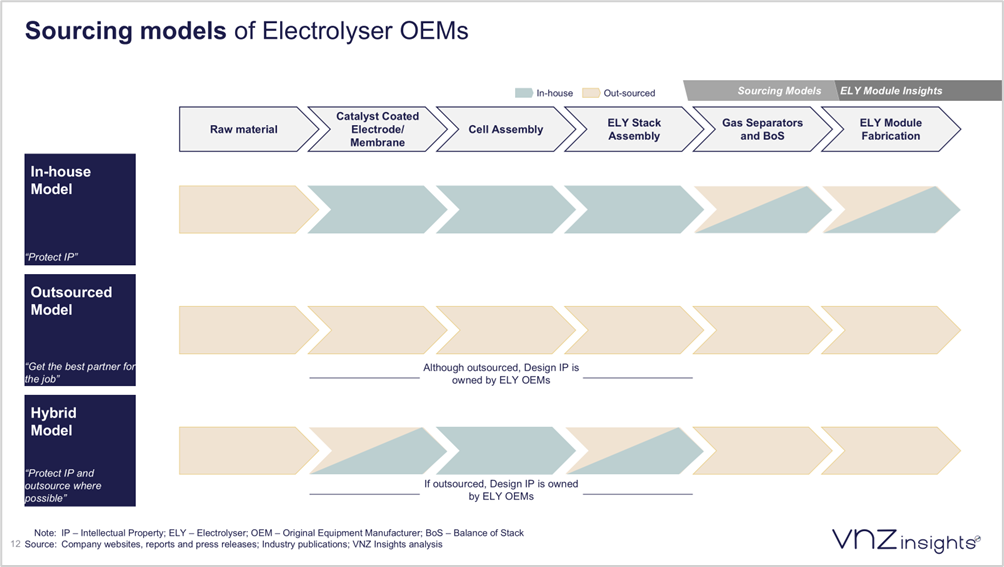

How electrolyser OEMs and suppliers are restructuring sourcing, manufacturing, and delivery for 50 MW+ hydrogen projects

REPORT

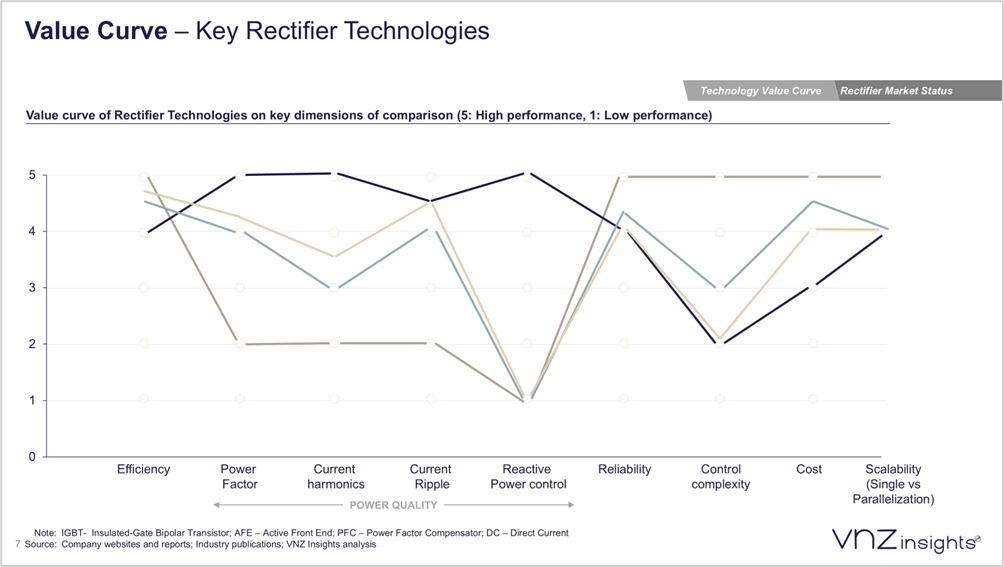

Rectifier and power supply unit technologies, market dynamics, and supplier positioning across global electrolyser projects

REPORT

Strategic Shifts, Technology Differentiation, and the Global Expansion of Chinese Electrolyser OEMs