2025 Green Hydrogen Round-up: the policies, auctions, and projects shaping what gets built next

Time to read:

10

mins

Disclaimer: IF25 commentary is based on draft terms and market guidance shared publicly. Final rules may differ.

Market context: why 2025 was a turning point for green hydrogen

The global electrolyser and green hydrogen market has entered a phase where scale is no longer theoretical. Multiple regions are now pushing projects beyond pilots into industrial-scale hydrogen and Power-to-X. But this phase also exposes constraints that were less visible at pilot scale: component bottlenecks, bankability concerns, local content rules, and the gap between an MoU and a bankable offtake.

1 | Major green hydrogen policy and regulation updates in 2025

Policy in 2025 could be best understood as a collection of market-shaping mechanisms like hydrogen bank auctions, national subsidies, reverse auctions for ammonia, and programmatic funding pools. Each market was structuring incentives slightly differently, but the direction is consistent - prioritizing projects that can move from development to commissioning on credible timelines.

European Commission

Europe remains a policy anchor through its Hydrogen Bank auction mechanism. Under IF24, the European Commission allocated USD 1 billion to 15 green hydrogen projects representing 2.3 GW of electrolyser capacity, and later invited additional reserve projects. In 2025, it also launched the IF25 Hydrogen Bank auction, committing about USD 1.5 billion to further scale production.

Netherlands

The Netherlands strengthened domestic deployment through major subsidy programs. It allocated about USD 1.4 billion to 12 green hydrogen projects totaling 702 MW of electrolyser capacity through the OWE Subsidy and SDE++ programs.

Spain

Spain allocated about USD 2.6 billion to 20+ green hydrogen projects through initiatives including Hydrogen Valleys, Auction-as-a-Service, NextGenerationEU, and RePowerEU. It also approved about USD 0.45 billion for IF25 Auctions-as-a-Service support.

India

India accelerated the market through auctions tied to fuels and industrial demand. SECI and state agencies awarded 724 kTPA of green ammonia capacity to 13 developers via reverse auctions. Separately, about USD 258 million was allocated to support around 450 kTPA of domestic green hydrogen production through auction routes.

Australia

Australia advanced large-scale hydrogen through Hydrogen Headstart. ARENA allocated about USD 0.8 billion to two hydrogen projects totaling about 1.5 GW under Round 1, and committed an additional USD 1.3 billion under Round 2 to accelerate scale.

2 | Which projects defined green hydrogen momentum in 2025?

Policy drives development, but commissioning signals execution. The projects below highlight where the ecosystem can deliver : large electrolyser deployments, integrated Power-to-X, and industrial use cases tied to fuels, chemicals, and hard-to-abate sectors.

Selected major green hydrogen and Power-to-X projects commissioned in 2025

China: world-scale execution and integrated Power-to-X

Europe: industrial decarbonisation and e-fuels as near-term anchors

China leads on multi-hundred-megawatt integrated projects, while Europe shows targeted execution in chemicals and e-fuels where demand is anchored.

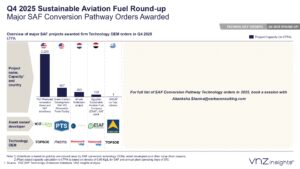

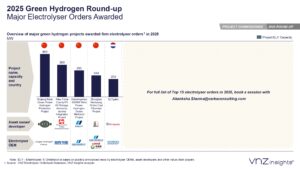

3 | Which projects drove major electrolyser orders in 2025?

Electrolyser orders are a forward indicator of where hydrogen capacity will show up next. In 2025, notable awarded orders clustered around industrial fuels and chemicals in China, and port and backbone-linked hubs in Europe. These awards signal where confidence is highest in execution, grid access, infrastructure, and demand.

Selected notable green hydrogen projects where electrolyser orders were awarded in 2025

Orders concentrate where demand and infrastructure are clearer, and where projects have higher confidence in execution timelines and bankability.

4 | IF25 Hydrogen Bank Auction: the shift from price-only competition to execution certainty

The 3rd Hydrogen Bank Auction (IF25) introduces a more selective framework, and it is explicitly positioned as a step up from earlier rounds. With EUR 1.3 billion allocated, the updated conditions signal a move away from purely price-driven competition

toward deliverability, compliance, and supply-chain robustness.

How IF23 and IF24 evolved into IF25 (what the framework is telling developers)

IF25 qualification factors: what changed, what is implied, and why it matters

Electrolyser origin and supply chain restrictions

IF25 strengthens sourcing criteria beyond the earlier approach. Restrictions now extend beyond stacks to other major components, increasing pressure on procurement strategy and early supplier selection.

Offtake agreements: recency and credibility as a qualification gate

IF25 increases scrutiny on market demand proof. Offtake documentation must reflect current traction, and documents such as MoUs, LoIs, or term sheets must be recent.

Realisation and execution timelines

IF25 emphasizes delivery timelines by tightening what is tolerated between grant signing, financial close, and entry into operation.

The market-level intent is to reduce “slow pipelines” and focus incentives on projects that can deliver on schedule.

Completion guarantees and bid seriousness

IF25 increases the cost of non-delivery by reinforcing completion guarantee expectations. This shifts the auction from “cheap bids” to “serious bids backed by capability and capital discipline”.

The commercial implications for different stakeholders

Developers

Electrolyser OEMs and supply chain players

Investors and lenders

Offtakers

This insight was powered by HyPrism.

Want more insights like this?

Access live data, project trackers, and market intelligence built for OEMs, EPCs, and investors.

Download the insight/report:

Click here to DownloadSources-

https://www.linkedin.com/posts/vnzinsights_top-green-hydrogen-projects-of-2025-activity-7416806067877068800-sC3c?utm_source=share&utm_medium=member_desktop&rcm=ACoAACOCu3YB0vggadlGysVLxKvF97KIfrjgVCY

Image Sources-